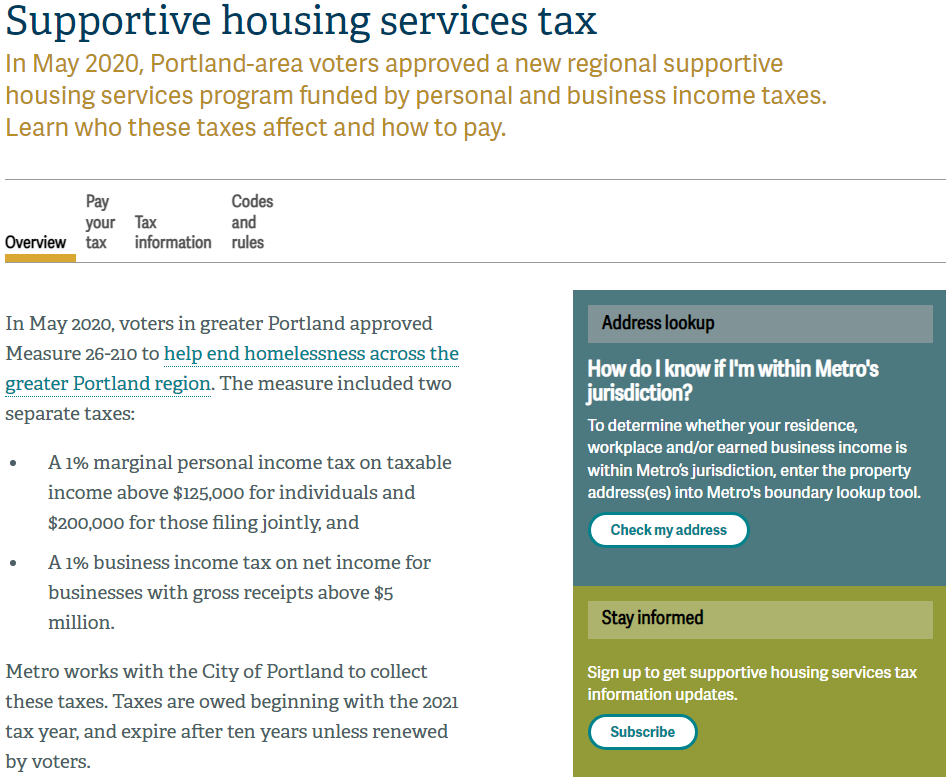

Metro Supportive Housing Services (SHS) Personal Income Tax

In May of 2020 voters in Portland approved a measure to raise money for people experiencing homelessness or at risk of experiencing homelessness. The program assesses a 1% tax on all taxable income of more than $125,000 for individuals and $200,000 for couples filing jointly. The program is also funded by a 1% tax on …

Metro Supportive Housing Services (SHS) Personal Income Tax Read More »