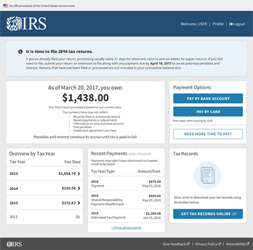

Opening an on-line account at irs.gov gives you access to your tax information at any time. Your IRS account contains important tax information and documents such as:

- Adjusted gross income. This can be useful if the taxpayer is using different tax software or a different tax preparer this year. They may need their AGI so they or their preparer can validate their identity.

- Economic Impact Payments. People can check the amounts of their Economic Impact Payments to help them accurately calculate any Recovery Rebate Credit they may be eligible for on their 2020 tax return. The EIP amounts can be found on the tax records tab. Amounts will show as Economic Impact Payment for the first payment and Additional Economic Impact Payment for the second payment. Individuals who are married filing joint will each need to sign into their own account to view their portion of the payments.

- Estimated tax payments. The total of any estimated tax payments made during the year or refunds applied as a credit can be found on the account balance tab. A record of each payment appears under payment activity.

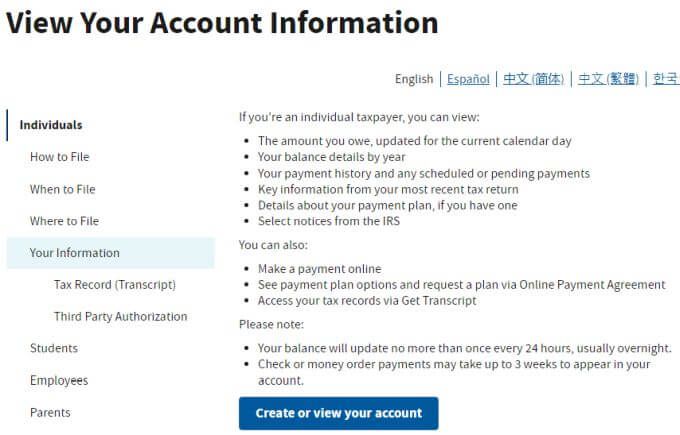

Additionally, taxpayers can view:

- The amount owed for any past years, updated for the current calendar day

- Payment history and any scheduled or pending payments

- Payment plan details

- Digital copies of select notices from the IRS

- Tax records using Get Transcript

If you have lost documents such as a W-2, retirement distribution, or 1099 as a contractor, your yearly transcript is available as a PDF in your IRS online account. The wage and income transcript will have all this information. Sample Below.

Here are a couple of links to IRS resources on opening an on-line account.

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.