Prior to 2020, if you were a freelancer, gig-worker, or your small business hired independent contractors, you issued or were issued a 1099-Misc for that work. On the form 1099-Misc, box 7 would display your independent contractor earnings.

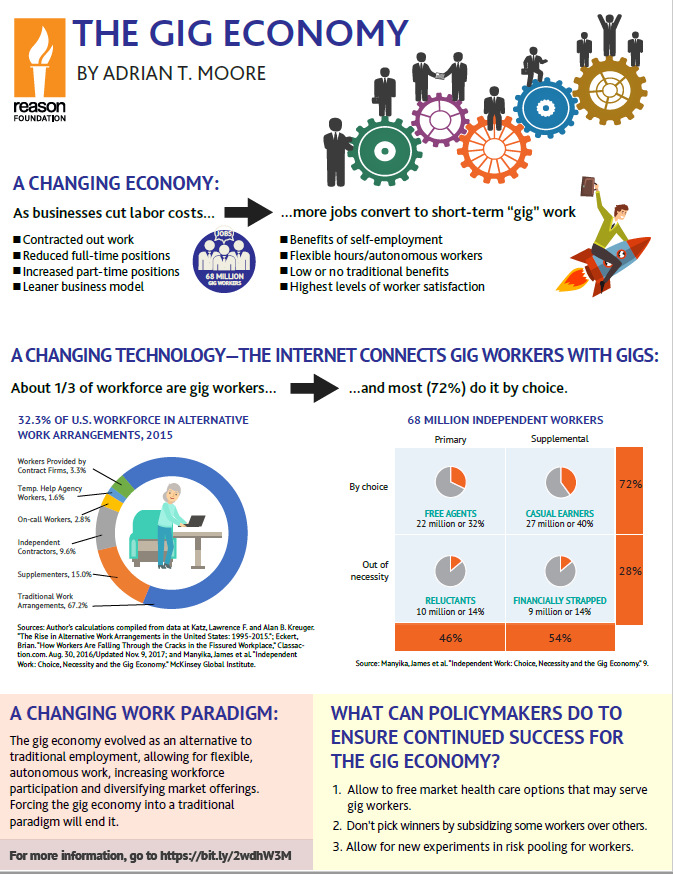

With the advent, or re-advent of the gig-economy (Uber, Lyft, Etsy, Bird, Lime, DoorDash, AirBnb, etc.), the IRS has introduced the new form 1099-NEC, just for reporting independent contractor income known as “Non-Employee Compensation”.

If you are an independent contractor, gig-worker, or hired an independent contractor in 2020, here is what you need to know about the changes:

If you are an independent contractor, gig-worker, or hired an independent contractor in 2020, here is what you need to know about the changes:

1099-NEC vs 1099-Misc

You will no longer be using the 1099-Misc. The 1099-NEC is now used to report all independent contractor income. The due date for the 1099-NEC is January 31. If January 31 does not fall on a business day, the due date will be moved to the next business day.

Who requires a Form 1099-NEC?

If you were an independent contractor and were paid over $600 for the year you will receive a 1099-NEC from your “employer”. This includes gig work such as Uber and DoorDash. If your business paid a contractor more than $600 in a tax year, you are required to file Form 1099-NEC with the IRS. Do not file a 1099-NEC for employees. Employees receive a W-2 not a 1099.

Who files the form 1099-NEC?

The business who hired a contractor files the form 1099-NEC. For every form there are two copies with the same information. One copy goes to the IRS and the other copy goes to the contractor. If you are the contractor receiving a copy of the 1099-NEC, all of your NEC income goes on a schedule C when you file your taxes for that year.

What you need to file a 1099-NEC?

Request a form W-9 or have the below information:

- Legal name or business name

- Business entity (sole, partnership, corp)

- Current address

- Taxpayer ID# (SS or EIN)

Submitting Copy A to the IRS

Small businesses will submit copy A of from 1099-NEC to the IRS by January 31st, 2021. You must also submit another from 1096 as a cover sheet to the 1099-NEC to the IRS. Once both are completed, you can mail them to the IRS.

You can also file electronically through the IRS’s FIRE (Filing Information Returns Electronically) System, however, you must have a software or service provider that will create the file in the proper format – a scanned or pdf copy will not be accepted.

You must also sign up and receive and Transmitter Control Code (TCC) before using the FIRE system. The TCC must be requested at least 30-days before the tax deadline by mailing or faxing form 4419 to the IRS. The IRS will contact you with your TCC which you can use to create your FIRE account.

You can email copy B of the 1099-NEC to your contractor, but they must provide consent per IRS rules. If consent cannot be obtained, you will have to mail the 1099-NEC to them.

Submitting 1099 forms in Oregon

This process is done separately from the federal 1099 and is available and the Oregon Department of Revenue’s Iwire site. Keep a copy of your federal 1099-NEC and you will have all of the information you need to file electronically through Iwire.

What are the penalties for missing the January 31st filing deadline?

- $50 if you file within 30-days

- $100 if you file >30 days late, but before 8/1

- $260 if you file on or after 8/1

If you are unable to file on time, you can request an extension by submitting form 8809 to the IRS. You will still need to supply the 1099-NEC forms to any contractors by January 31st.

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.