To claim a deduction for charitable donations on your taxes, you must have received nothing in return for your donation, and you must itemize deductions on your tax return by filing Schedule A form 1040. This deduction can be taken on your Federal and/or State tax return and includes the donation of cash and household items.

Rules for tax deductible donations

- Donate to a qualified tax-exempt 501(c)(3)

- IRS.gov has a Tax-Exempt Organization search tool here. https://www.irs.gov/charities-non-profits/tax-exempt-organization-search. Gifts to friends, family, Kickstarter campaigns, or any non 501(c)(3) organization do not qualify.

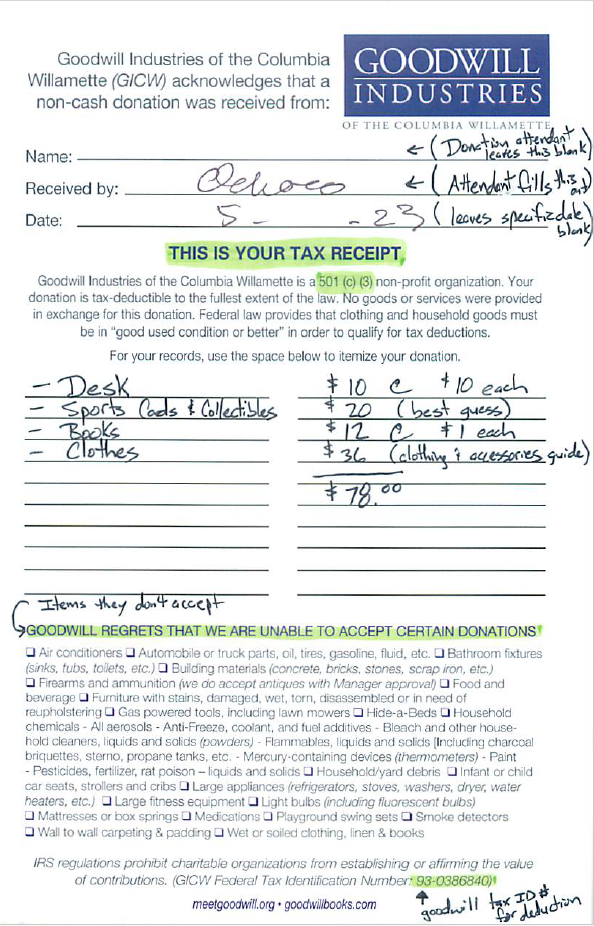

- Document your charitable contributions

- If you made a monetary contribution, qualifying documentation includes a receipt from the charity, a credit card statement, bank statement, or cancelled check. Any cash donation greater than $250.00 to a single charity requires a written letter from the organization acknowledging the year and amount of contribution made. (most charities automatically snail mail you this letter at the end of each year)

- If you made contributions to charity as an automatic deduction through your employer, your W-2 and/or year-end pay stub will show the amount contributed.

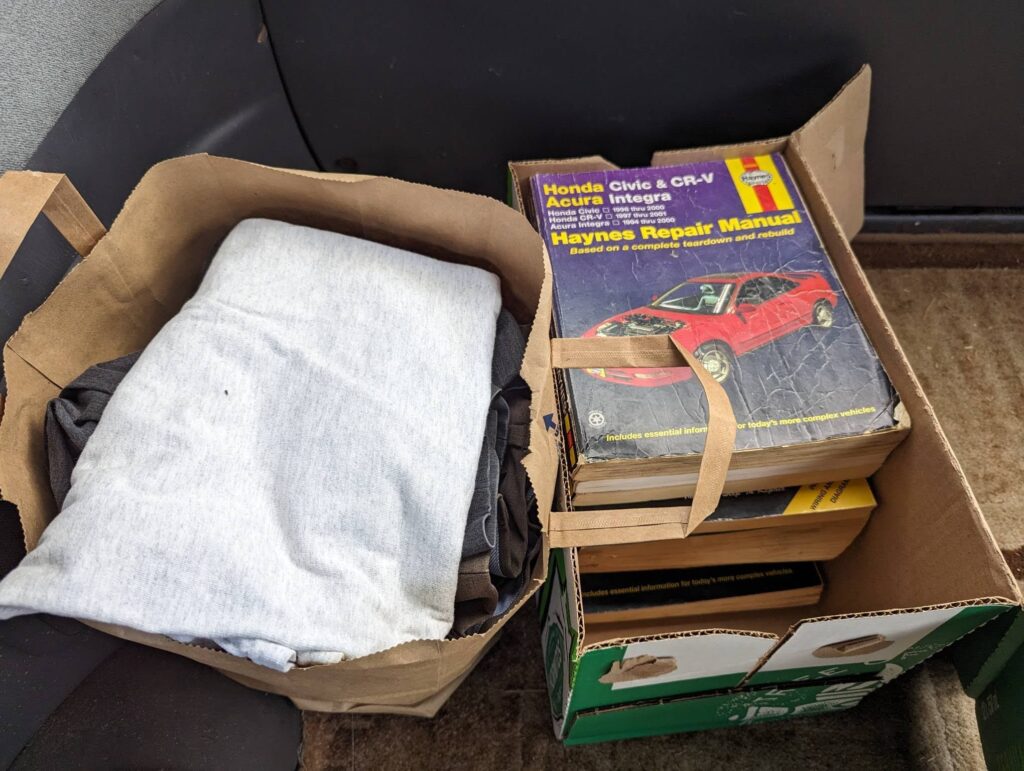

- If you deduct $500 or more worth of noncash donations, you’ll need to fill out form 8283. Additionally, it is a good idea to take photos of larger value donations and keep them with your records and the 501(c)(3) receipt. You do not need to keep detailed records or take photos for any year that you only take a grand total of $500 worth of household donations to goodwill or another charity. You can use the Goodwill Donation Valuation Guide to calculate the appropriate deduction for individual items.

- Volunteering

- You cannot deduct the value of your time or service.

- You can deduct expenses related to the volunteering activity.

- Expenses must be directly and solely connected to the volunteer work you performed. This includes items you purchase and donate directly for use at the charitable organization. Save all receipts.

- Mileage driving to and from or delivering items to events is tax deductible. (Date, activity, total round-trip mileage).

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor SST will be responsible for any error, omission, or inaccuracy under any circumstance.