An IP PIN (Identity Protection Personal Identification Number) is a six-digit number issued by the IRS to a taxpayer that prevents someone else from fraudulently filing a tax return. The IP PIN helps the treasury verify a taxpayer’s identity when they file an electronic or paper tax return.

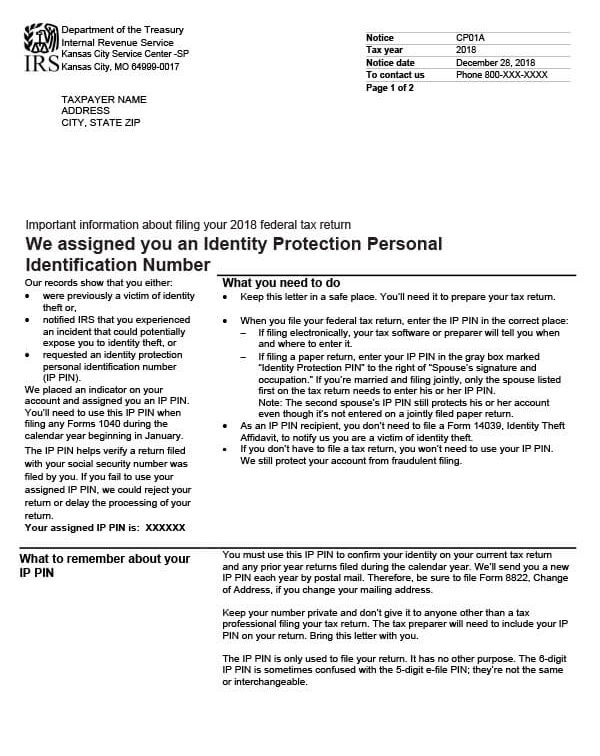

If you are a confirmed victim of tax-related identity theft, the IRS will mail you a CP01A notice with your new IP PIN every year.

Taxpayers can also acquire an IP PIN as a pro-active step to protect their identity even if they have not been a victim of identity theft. The IRS has an Identity Protection Opt-In Program to help protect people against tax-related identity theft.

Here are a few other things taxpayers and tax professionals should know about the IP PIN:

- It’s a 6-digit number only known to the taxpayer and the IRS.

- The opt-in program is voluntary.

- The IP PIN should be entered on the electronic tax return when prompted by the software product or on a paper return next to the signature line.

- The IP PIN is valid for one calendar year; a new IP PIN is generated each year.

- Only taxpayers who can verify their identities may obtain an IP PIN.

- IP PIN users should never share their number with anyone but the IRS and their trusted tax preparation provider. The IRS will never call, email, or text a request for the IP PIN.

- Tax professionals cannot obtain an IP PIN on behalf of clients. Taxpayers must obtain their own IP PIN.

To obtain an IP PIN, the best option is the Get an IP PIN online tool. Taxpayers must validate their identities through ID.me to access the tool and their IP PIN. Before attempting this process, see How to Register for Certain Online Self-Help Tools.

If taxpayers are unable to validate their identity online and if their income is below $73,000 for individuals or below $146,000 for married couples, they may file Form 15227, Application for an Identity Protection Personal Identification Number. The IRS will call the telephone number provided on Form 15227 to validate their identity. Once verified, the taxpayer will receive an IP PIN via U.S. Postal Service within four to six weeks.

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.