What is the TriMet Self-Employment Tax

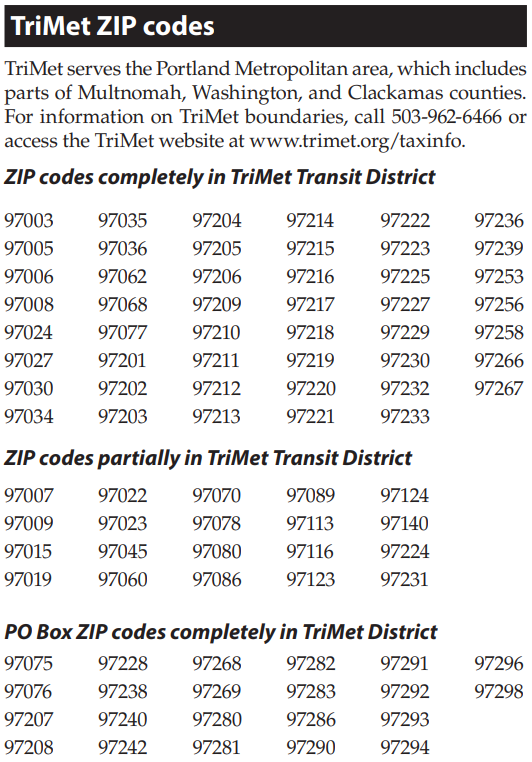

The TMSE is a tax to help fund mass transportation in the TriMet District and is applied to the earnings of any individual doing business or providing services in the district. The Oregon Department of Revenue collects the tax from anyone doing business in Multnomah, Clackamas, and Washington counties.

The current tax rate is .7837%

Who must pay this tax?

Anyone who has self-employment earnings from business or service activities carried on in the TriMet District must pay this tax. The only exemptions are for ministers, insurance agents, and C and S corporations. The Oregon Department of Revenue will collect this tax from anyone else with greater than $400 in self-employment net earnings.

How to file?

You can file you TriMet tax return using Revenue Online at Oregon.gov or you can mail in your OR-TM form to the Oregon Department of Revenue. If you pay someone to file your federal and state taxes, they can also file your TriMet tax return electronically.

How to Pay?

Make payments on-line at Oregon.gov/dor or send a paper check or money order to: Oregon Department of Revenue, PO Box 14950, Salem OR 97309-0950.

When is the tax return and payment due?

The due date is the same due date as your federal tax return. If you file an extension on your federal tax return the extension is honored by Oregon for your State and TriMet tax returns. (6-month extension)

Is there a Penalty for filing late?

Yes – 5% of the tax due. If the TM tax return is filed 3-months after the due date the late-filing penalty increases to 20%. A 100% penalty is assessed if you don’t file a return for three consecutive years.

https://www.oregon.gov/dor/programs/businesses/Pages/statewide-transit-tax.aspx

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.