Dutch Bros, the Oregon based drive though coffee chain with more than 450 stores, formally filed for its initial public offering on Friday 8/20/2021. The number of shares and the price range for the proposed offering have yet to be determined and the offering date won’t be finalized until after the SEC completes its review process.  Bloomberg reported in early May of 2021 that the Dutch Bros chain was seeking to be valued around $3 billion and that it was speaking to advisers. The IPO will position Dutch Bros to be one of Oregon’s largest businesses.

Bloomberg reported in early May of 2021 that the Dutch Bros chain was seeking to be valued around $3 billion and that it was speaking to advisers. The IPO will position Dutch Bros to be one of Oregon’s largest businesses.

The company will use the proceeds from the IPO to pay down $192 million in long-term debt and has warned it may take on more debt to support future expansion. Concerns do exist around weakness in Dutch Bros historical accounting. The company has reportedly hired more financial accountants this year to tighten internal controls. The IPO will also reveal how much of the company is owned by investment firm TSG, Travis Boersma, and other family members.

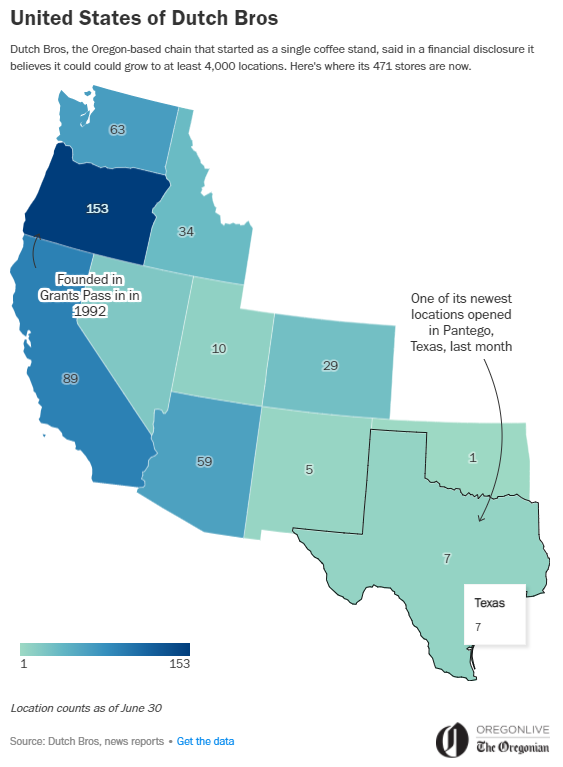

Dutch Bros was founded in 1992 with a single pushcart in Grants Pass by brothers Travis and Dane Boersma. The chain currently has 471 stores across the west from Washington to Oklahoma. Dane Boersma died in 2009 from Lou Gehrig’s disease and the company holds an annual ALS fundraiser “Drink one for Dane” in his name. 2020’s “Drink one for Dane” raised over $1.3 million for the Muscular Dystrophy Association (MDA).

- No Oregon company has raised $100 million in an IPO since 2004 when Cascade Microtech in Beaverton went public.

- Dutch Bros believes it can grow tenfold to as many as 4,000 locations

- The company intends to trade on the New York Stock Exchange under the ticker symbol “BROS”

- Dutch Bros reported its sales totaled $327.4 million in 2020 – up 27% from 2019

- $5.7 million was in profit.

- Dutch Bros no longer awards franchises and nearly half of its stores are company owned.

Information Courtesy: Bloomberg Media, OregonLive, Dutch Bros, and the Muscular Dystrophy Assocation (MDA)

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.