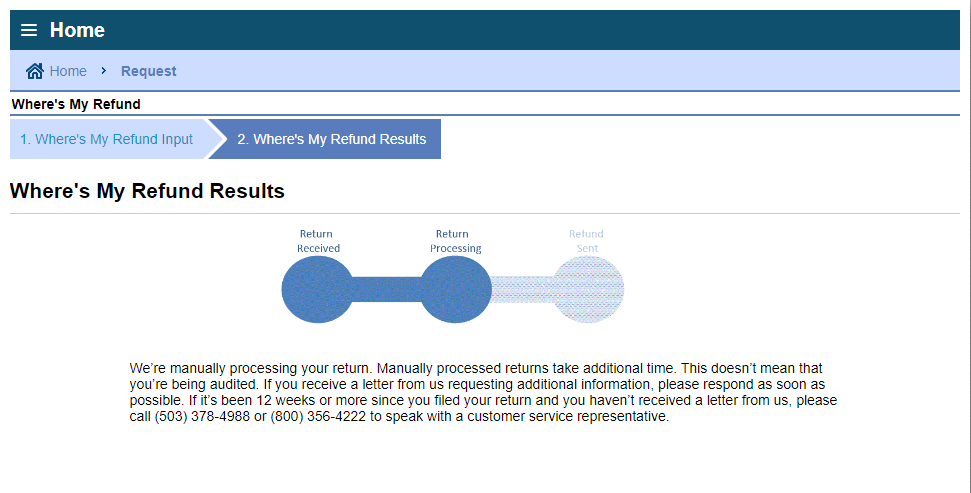

Oregon Manual Processing

In 2013, a Portland, Oregon man electronically filed at least 66 false tax returns requesting more than $300,000 in tax refunds from the Oregon Department of Revenue. Since then, every tax season we see a growing number of Oregon taxpayers being selected for “Oregon manual processing”. Typically, the most common reason the Oregon Department of …