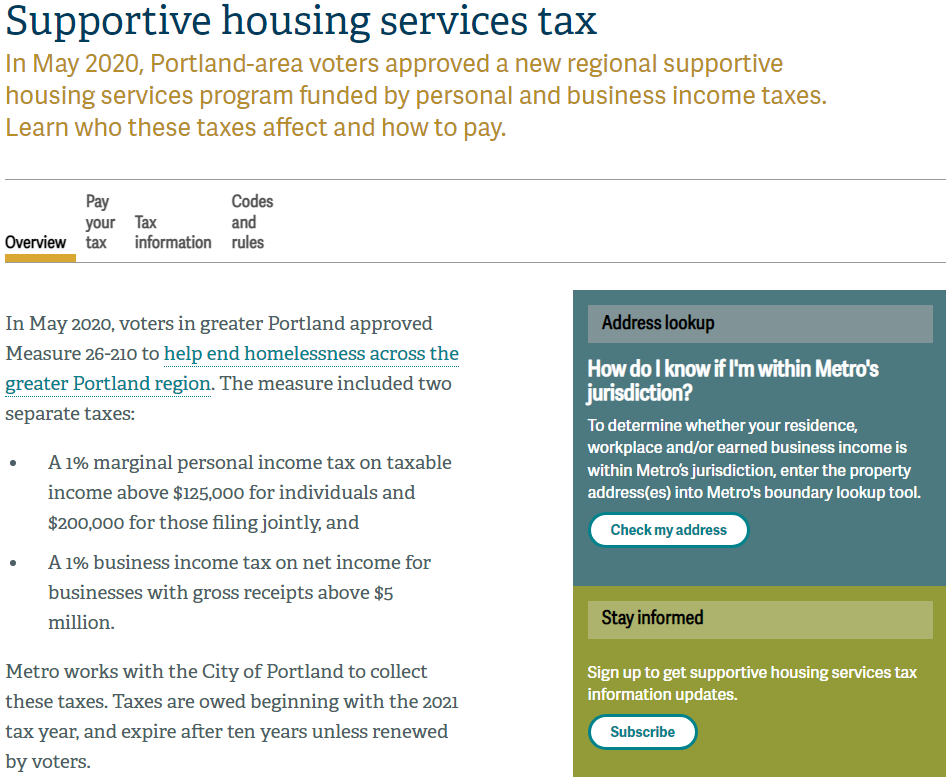

In May of 2020 voters in Portland approved a measure to raise money for people experiencing homelessness or at risk of experiencing homelessness. The program assesses a 1% tax on all taxable income of more than $125,000 for individuals and $200,000 for couples filing jointly. The program is also funded by a 1% tax on profits from businesses with gross receipts of more than $5 million.

https://www.oregonmetro.gov/public-projects/supportive-housing-services-tax

The tax is assessed on people living withing Metro’s jurisdiction (Multnomah, Clackamas, and Washington County) and is due by April 15th of each year. Withholding from your employer for the tax program is available if your employer has the payroll system to support it.

https://www.oregonmetro.gov/public-projects/supportive-housing-services-tax/pay-your-tax

Taxpayers who fall under Metro’s qualifications will have to file a separate tax return through the city of Portland Revenue Division. Payments will be processed here too. Any retirement income other than Oregon PERS and FERS is subject to the tax if total income exceeds the requirement.

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.