A Social Security number (SSN) is a nine-digit number that the U.S. government issues to all U.S. citizens and eligible U.S. residents who apply for one. The government uses this number to keep track of your lifetime earnings and the number of years worked.

When the time comes to retire, or if you ever need to receive Social Security disability income, the government uses the information about your contributions to Social Security to determine your eligibility and calculate your benefit payments.

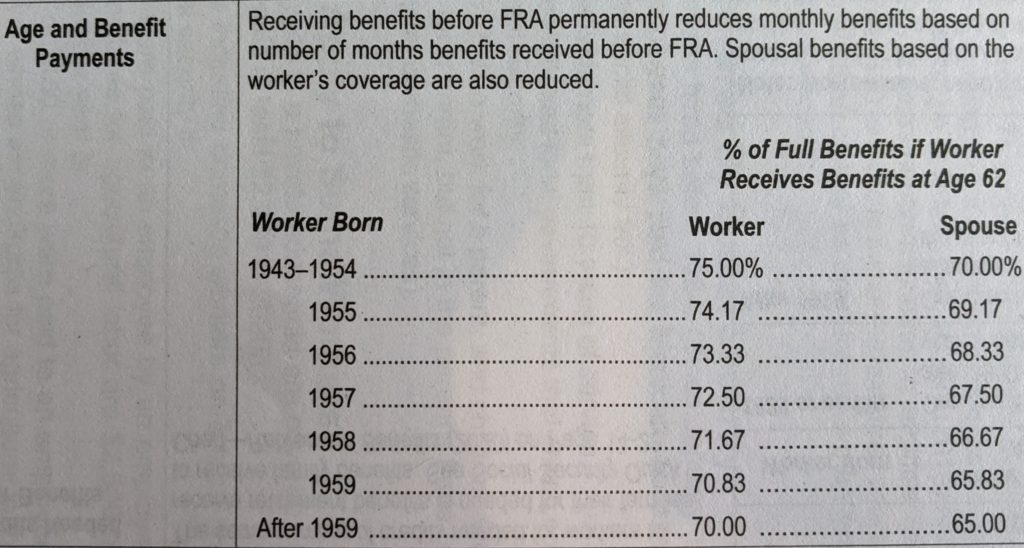

You can retire as early as age 62 and receive a reduced amount of benefits than if you were to end your working career at full retirement age (FRA) of 67. See the chart below to see the pro-ration of reduced benefits for retiring before FRA.

An individual’s social security statement is available at www.ssa.gov/myaccount. The statement includes estimates of the individual’s retirement and disability benefits, lifetime earnings according to social security’s record, and the estimated social security and Medicare taxes the individual has paid.

An estimate of social security benefits can be found on the social security statement or online at www.ssa.gov/benefits/retirement/estimatr.html. There are calculators that estimate potential benefit amounts assuming certain retirement dates and different levels of future earnings. The calculators also show disability and survivor benefit amounts.

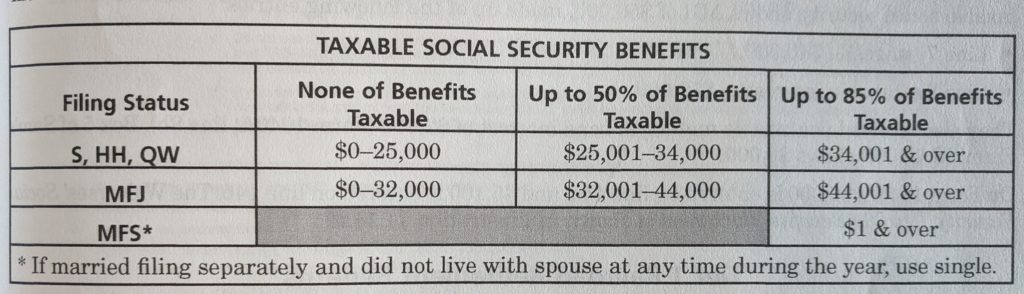

The amount of a taxpayer’s social security or tier 1 railroad retirement benefits subject to federal tax varies from zero to 85% depending upon filing status and other income. A portion of social security benefits is taxed if other income above a “base amount” is received in addition to social security benefits (W-2, pension, annuity, etc). Oregon does not tax social security benefits.

Single and Head of Household tax returns: If combined income is over $25,000 (base amount) and under $34,001, up to %50 of benefits are taxable. If combined income is above $34,000, up to 85% of benefits are taxable.

Married Filing Jointly tax returns: If combined income is over $32,000 (base amount) and under $44,001, up to 50% of benefits are taxable. If combined income is above $44,000, up to 85% of benefits are taxable.

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.