Cryptocurrency is a digital currency exchanged through a computer network that is not reliant on central authority such as government or bank. Individual coin ownership records are stored in a digital ledger verifying the transfer of coin ownership. The IRS uses the term “virtual currency” to describe the various types of virtual currency that are used as a medium of exchange. Created in 2009 by someone using the pseudonym Satoshi Nakamoto, Bitcoin (BTC) is the original cryptocurrency. Other cryptocurrencies include;

- Ethereum (ETH) Market cap: Over £348 billion

- Tether (USDT) Market cap: Over £54 billion

- S. Dollar Coin (USDC) Market cap: Over £45 billion

- Binance Coin (BNB) Market cap: Over £35 billion

- XRP (XRP) Market cap: Over £13 billion

- Cardano (ADA) Market cap: Over £13 billion

- Solana (SOL) Market cap: Over £12 billion

- Dogecoin (DOGE) Market cap: Over £8 billion

- Polkadot (DOT) Market cap: Over £6 billion

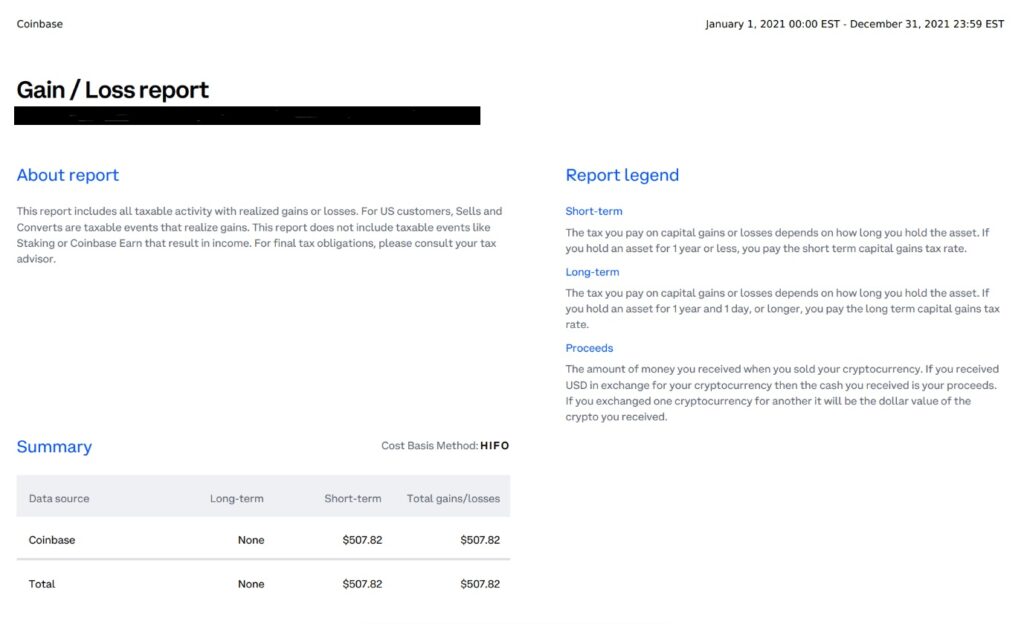

Purchasing cryptocurrency just like purchasing stock in a company is not a taxable event. Selling cryptocurrency at a loss or gain is a taxable event just as selling stock in a company is. If there is a gain the IRS considers this taxable income and will require you to report it as such. Short-term gain is property (virtual currency in this case) held 1-year or less. Long-term gain is property held greater than 1-year. Long-term gains are usually taxed at a lower rate than short-term gains. If the gain from crypto-transactions is not reported to the IRS on the taxpayer’s tax return in the year the transaction occurred, the taxpayer will eventually receive a bill from the IRS including the balance due, penalties, and interest. If the crypto-transactions result in a loss, the taxpayer may be able to use the loss to offset gains or other taxable income.

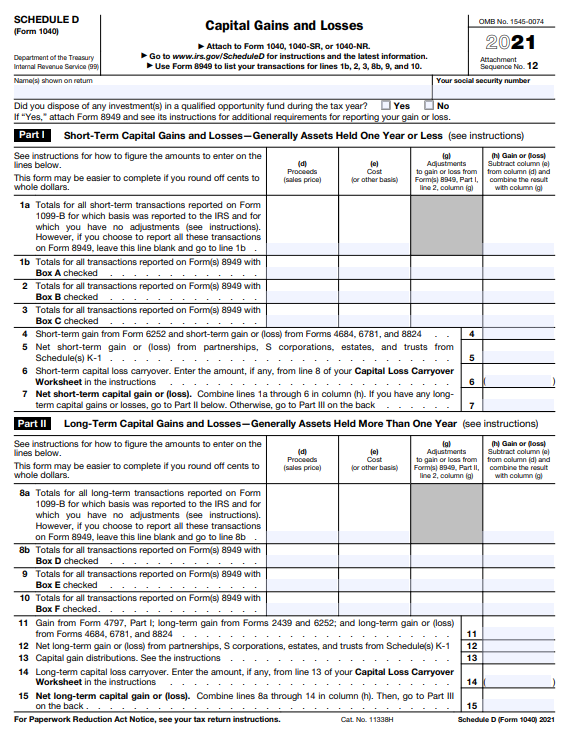

The reporting process and taxability of crypto-transactions is guided by IRS Publication 544 (Sales and Other Dispositions of Assets). If you sold property, such as stocks, commodities, or virtual currency through a broker, you should receive form 1099-B (image below).

For crypto-traders, your 1099-B is available as a pdf in your on-line crypto account annually by February 15th. Short-term gains and losses are transferred from your 1099-B and reported individually by using form 8949 and/or Schedule D. These forms then flow into your personal 1040 and will either increase or decrease your federal tax liability depending on if you have recognized gain or loss from the crypto-transactions.

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.