In 2013, a Portland, Oregon man electronically filed at least 66 false tax returns requesting more than $300,000 in tax refunds from the Oregon Department of Revenue. Since then, every tax season we see a growing number of Oregon taxpayers being selected for “Oregon manual processing”. Typically, the most common reason the Oregon Department of Revenue puts a tax return under “manual processing” is to further review the tax return to confirm that it was you who filed it and not someone else trying to steal your identity. If you are due an Oregon refund, they’ll want to ensure that the refund goes to you and not the identity thief’s bank account.

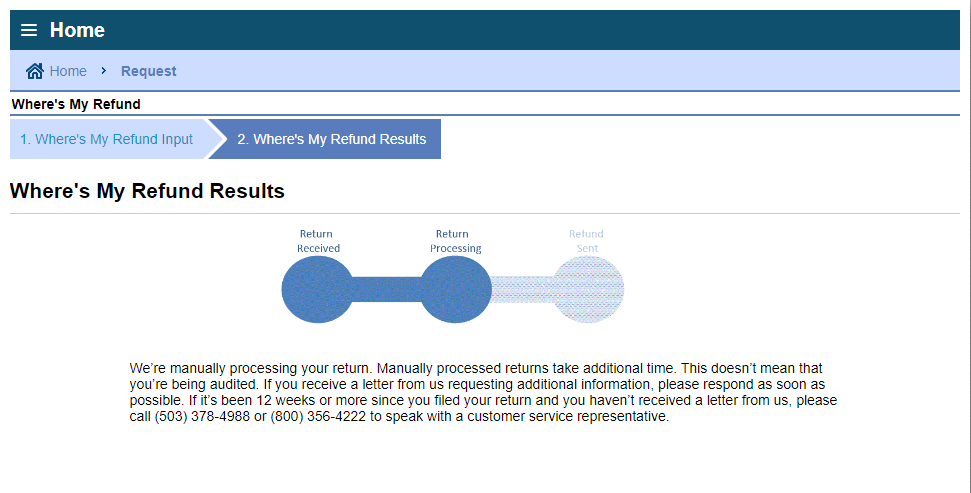

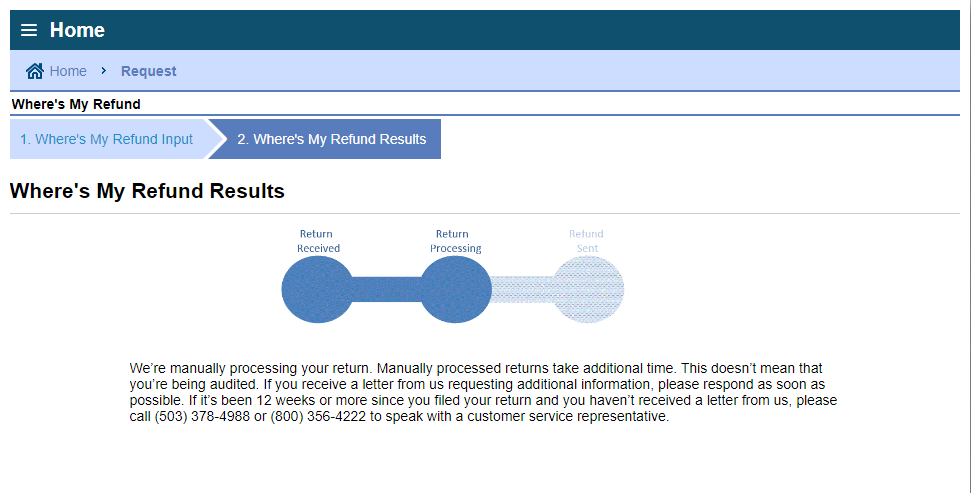

You can check the status of your Oregon refund at any time at the Oregon Department of Revenue’s “where is my Oregon refund” tool. If you receive a notification that looks like the image below, then your tax return is under review.

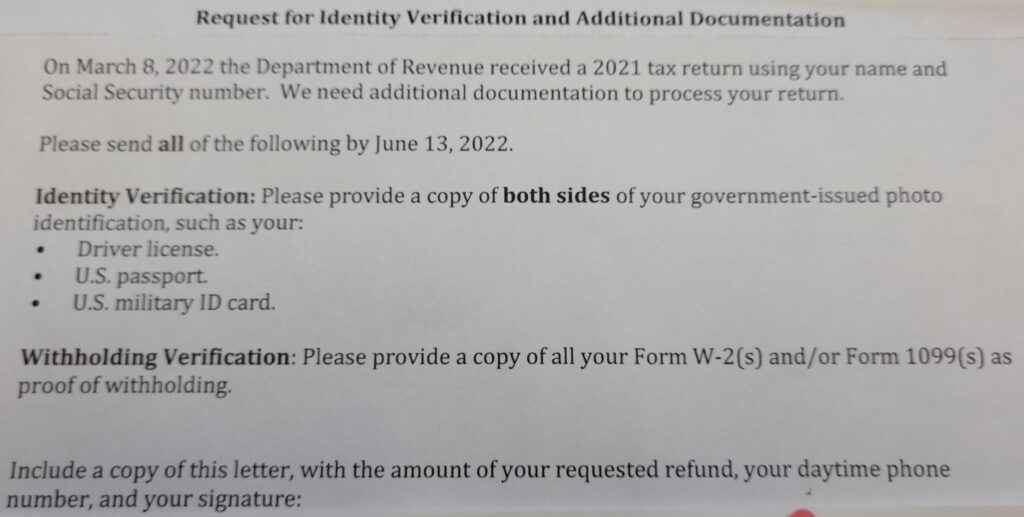

If the Oregon Department of Revenue puts your tax return under “manual review”, you will receive a letter in the mail that looks like the image below.

You must respond to the letter or Oregon will not release your refund. You can respond by mailing in the documentation they have requested or uploading the documents to your Revenue On-line account.

https://solidstatetax.com/creating-a-taxpayers-revenue-on-line-account-in-oregon/

Other reasons your Federal or State tax return may be put under “review” or “manual processing”:

- You are claiming the Earned Income Credit.

- You are claiming dependents on your tax return who have different last names than you do.

- Your refund is over $5,000.

- You are claiming the American Opportunity Tax Credit for higher education expenses.

- You are a filing a federal or state tax return for the first time.

- You are filing your first federal or state tax return in the last 10 years.

- You have not filed one or more back-year federal or state tax returns.

- The IRS needs to verify your identity to be sure it is you (and not a fraudster) that filed your tax return.

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.