1/10/2024 – IRS announces delay for implementation of $600 reporting threshold for third-party payment platforms’ Forms 1099-K until 2024 tax year.

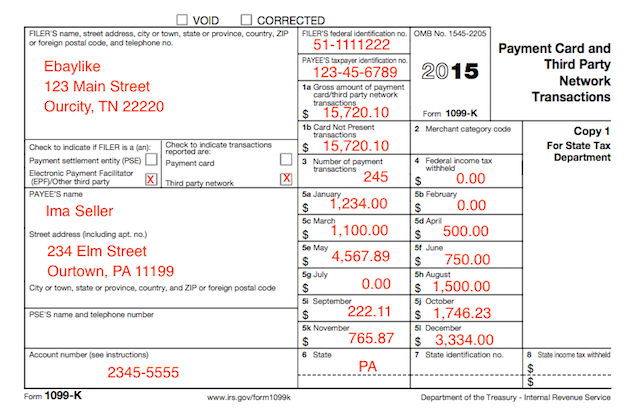

The American Rescue Plan Act of 2021 significantly modified the reporting threshold associated with form 1099-K, Payment Card and Third-Party Network Transactions, from $20,000 AND more than 200 transactions per year down to annual gross payments exceeding $600, AND any number of transactions. The new rule was effective beginning with payment transactions settled after December 31 ,2021.

If in Tax-year 2022 you received any payment card transactions (e.g., debit, credit, or stored-value cards), the Payment Settlement Entity (PSE) will now issue you an annual 1099-K. The form 1099-K will be issued to the taxpayer by PSE’s such as Clover, Square, PayPal, Venmo, Zelle, and CashApp for any annual total income greater than $600.

Form 1099-K includes the gross amount of all reportable payment transactions for the tax year and a taxpayer will receive one from each payment settlement entity from which they received payments.

You have the choice of either reporting the income from the 1099-K on your personal tax return and paying the tax on it, or taking expenses against the income by filing a schedule C.

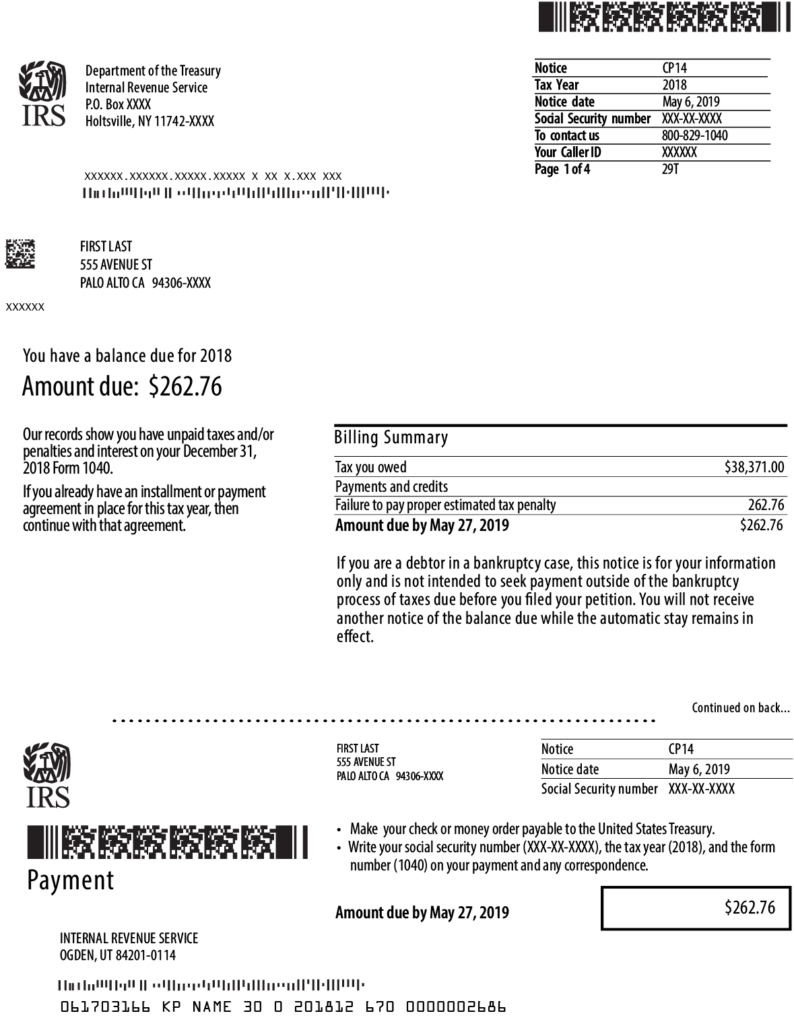

If the income from each 1099-K is not reported on the taxpayer’s tax return, The IRS will eventually snail mail a letter titled CP14. The CP14 will be a bill requesting the tax due on the under-reported income. The bill will also include penalties and interest. If taxes are due to any state or local entity as a result of the 1099-k income, the taxpayer will receive letters requesting tax, penalty, and interest from them as well.

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.