(ORS 316.693)

[Subtraction Code: 351]

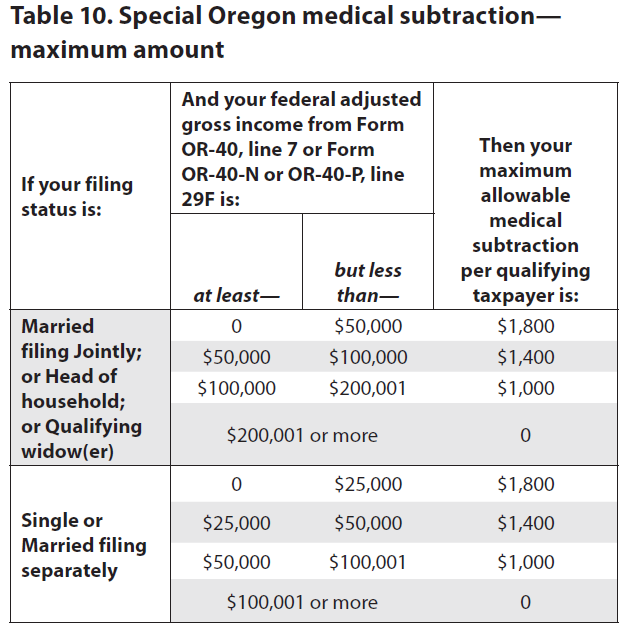

If you or your spouse turned 66 by the end of the tax year and have medical and/or dental expenses, you may qualify for the Special Oregon Medical Subtraction if:

- You or your spouse turned 66 by the end of the tax year

- Your federal AGI (adjusted gross income) doesn’t exceed $200,000 ($100,000 if filing single or separately)

- You or your spouse have qualifying medical or dental expenses

Medical or dental expenses qualify if they can be included in itemized deductions. (IRS Pub 502)

Examples of qualifying expenses include but are not limited to:

- Acupuncture

- Ambulance

- Artificial Teeth

- Car expenses (mileage)

- Chiropractor

- Dental

- Eye exam, glasses, and surgery

- Guide dog or service animal

- Hearing aids

- Optometrist

- Prescriptions

- Surgery

- X-Ray

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.