When you sell your primary home, you may be able to exclude $250,000 of gain from the sale and avoid paying taxes on it. The capital gain exclusion is increased to $500,000 for a married couple filing jointly. To qualify for the maximum exclusion of gain, you must meet the Eligibility Test.

Eligibility Test Step 1 – Automatic Disqualification

- You acquired the property through a like-kind exchange (1031 exchange), during the past 5-years.

- You are subject to expatriate tax

Eligibility Test Step 2 – Ownership

If you owned the home for at least 2-years out of the last 5-years leading up to the date of sale (date of closing), you meet the ownership requirement. For a married couple filing jointly, only one spouse must meet the ownership requirement.

Eligibility Test Step 3 – Residence

If you owned the home and used it as your primary residence for at least 2-years of the last 5-years, you meet the residence requirement. The 24-month requirement can fall anywhere within the 5-year period, and it doesn’t have to be a single block of time. Unlike the Ownership requirement, each spouse must meet the residence requirement individually for a married couple filing jointly to get the full exclusion.

Eligibility Test Step 4 – Look Back

If you didn’t sell another home during the 2-year period before the date of sale, you meet the look-back requirement. You may take the exclusion only once during a 2-year period.

Eligibility Test Step 5 – Exceptions to the Eligibility Test

- Separation or divorce

- Death of a spouse

- Previous home destroyed or condemned

- Service member during the ownership

- Like-Kind (1031) Exchange

- Vacation home or Rental

Partial Exclusion of Gain

If you don’t meet the Eligibility Test, you may still qualify for a partial exclusion if the main reason for your home sale was a change in workplace location, a health issue, or an unforeseeable event. For more information on the Partial Exclusion see IRS Publication 523.

Basis Adjustments

You should include many, but not all, costs associated with the purchase and maintenance of your home in the basis adjustment for your primary home.

- Sale Fees and Closing Costs

- Home Improvements

- Home Acquired Through a Trade

- Home Foreclosed, Repossessed, or Abandoned

- Home Destroyed or Condemned

- Home Received in Divorce

- Home Received as a Gift

- Home Inherited

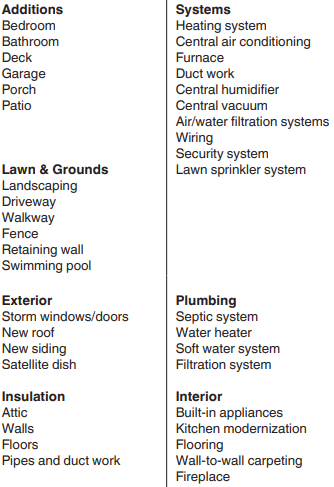

The image below shows examples of home improvements that increase basis

Once you sell your home, the title company will provide you with an enormous packet of documents. There are (2) documents in there that you will need for your taxes.

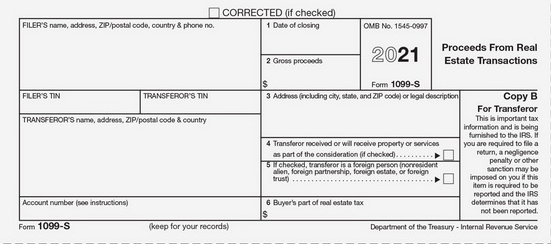

The 1099-S (Image Below)

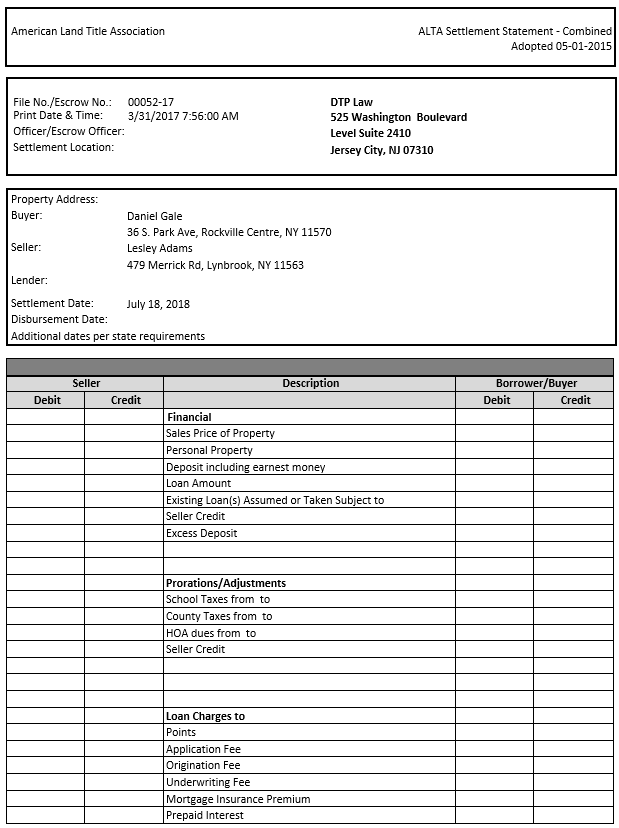

And the ALTA settlement statement (Image Below)

The Basis adjustments (primarily home improvements), combined with the fees and closing costs from your ALTA settlement statement are what you will need to calculate the capital gain or exclusion from the sale of your main home. These are reported on tax forms 8949 and Schedule D.

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.