The IRS can be extremely difficult to communicate with by telephone. You may navigate through a phone tree for 10-minutes before being informed by an automated recording that “We are unable to process your request at this time, please call back the next business day.” After this recording you’ll hear a dial tone. For taxpayers who are having difficulty communicating with the IRS by telephone there are 2 options.

- Set up your personal on-line account at IRS.gov. (note – this is not easy and unfortunately it is a process that takes trial and error until success. The only way to accomplish setting up your IRS on-line account is with persistence. A taxpayer will not accomplish setting up their IRS on-line account without being persistent).

If your IRS on-line account doesn’t have the answers you need, then a taxpayer can visit Portland’s IRS Taxpayer Assistance Center.

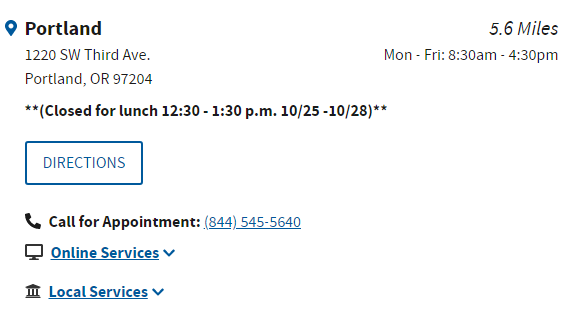

- Portland’s IRS-TAC is in the Edith Green-Wendell Wyatt Federal Building in downtown PDX. You may try to call for an appointment before your visit at (844)-545-5640. If you are unable to schedule an appointment or are continuously disconnected, we recommend physically visiting Portland’s IRS-TAC at 1220 SW 3rd Ave, Portland, OR 97204.

Upon entering the federal building, you will pass through a physical access security system. Leave any weapons, including a small pocketknife behind. Any other metal devices including a belt and maybe shoes will need to be removed. After you pass through security, the IRS Taxpayer Assistance Center is down the hall, left down the stairs, and straight ahead to the first glass doors.

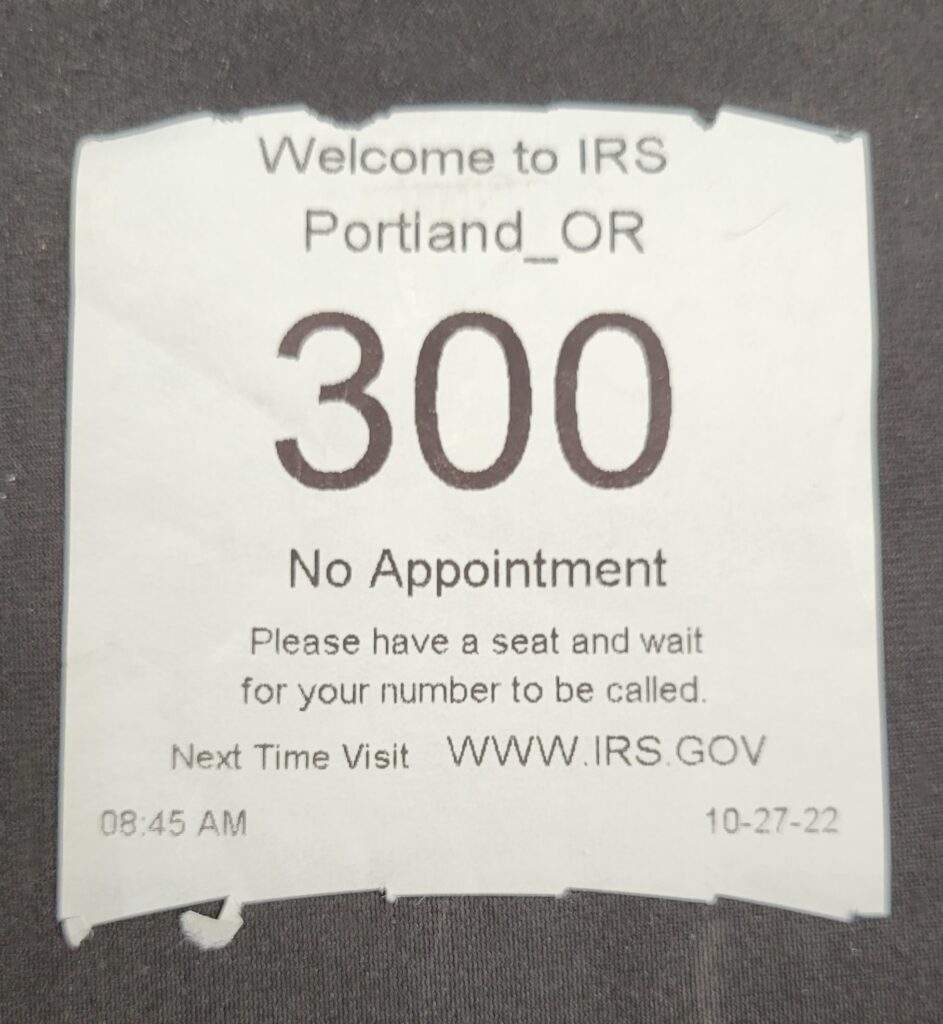

After entering through the glass doors the TAC admin will issue you a ticket.

To ensure the minimum total time of your visit, we recommend arriving at the IRS office when they open at 8:30 AM.

Once your number is called you will be asked to approach the tax desk and type your social security number into a keypad. You do not need to bring your SS card with you to this visit if you know your SS#. At this time, you will be asked to provide a copy of your State ID or driver’s license. The IRS cannot help you if you forget to bring your photo ID. Pens, pencils, and paper are not provided at any of the tax desks and you will need to take notes so don’t forget to bring your own. Prior to your appointment or visit, we advise to print out and bring along your federal tax return, schedules, and income documents relevant to the tax year you have in question. The more information you bring to this appointment the less likely you will need to come back for a repeat visit to the IRS-TAC. There is plenty of available street parking near the federal building. If your appointment takes longer than expected, you can extend your parking fee at Portland’s parking app parkingkitty.com. As of 10/28/2022 you are not required to wear a mask in the Edith Green-Wendell Wyatt federal building.

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.