The Oregon Office of Economic Analysis (OEA) reconciles Oregon’s annual tax revenue. An annual kicker credit goes into effect when the actual state revenue exceeds the forecasted revenue by at least 2%. An amount calculated by the OEA is then returned to Oregon taxpayers through a credit on their tax return.

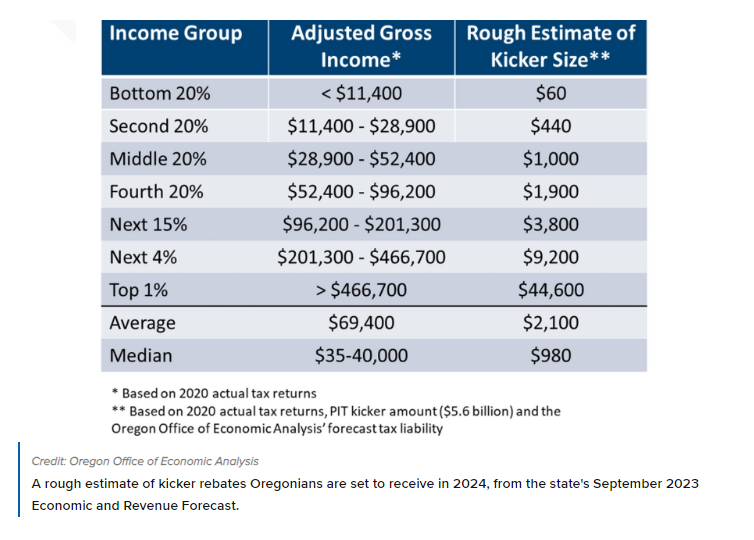

On October 9th of 2023, Oregon announced a record $5.6 Billion dollar revenue surplus to be returned to taxpayers in the form of an income tax credit known as the Oregon “Kicker” Credit. To calculate the amount of your 2024 kicker credit, multiply your 2022 Oregon tax liability (line 22 of OR-40) by 44.28%. The Oregon Department of Revenue also has a tool to assist taxpayers HERE that will calculate your kicker for you. You’ll need your name, SS#, filing status for 2022, and expected filing status for 2023.

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.