Q&A WITH A PLAN OF ACTION

Are my unemployment benefits taxable?

By law, all unemployment benefits are taxable in Oregon and must be reported on both your federal and Oregon tax returns.

Does this include benefits I received during the Coronavirus Aid, Relief, and Economic Security (CARES) Act?

Yes – all unemployment benefits are taxable to fed and Oregon including those received under the (CARES) Act.

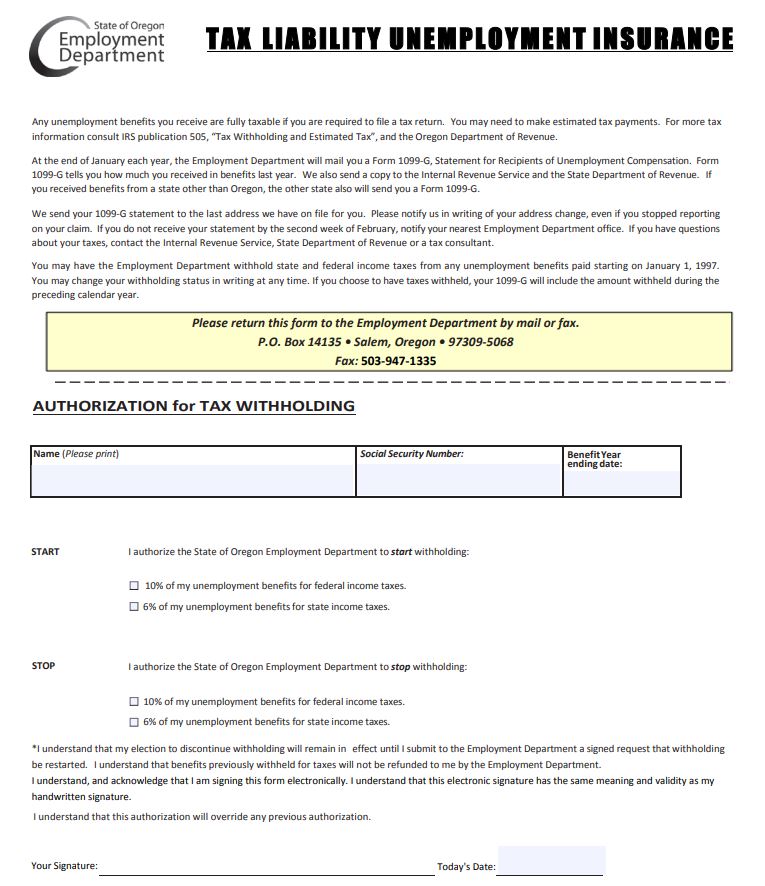

Do I need to have taxes withheld or are they already being taken out?

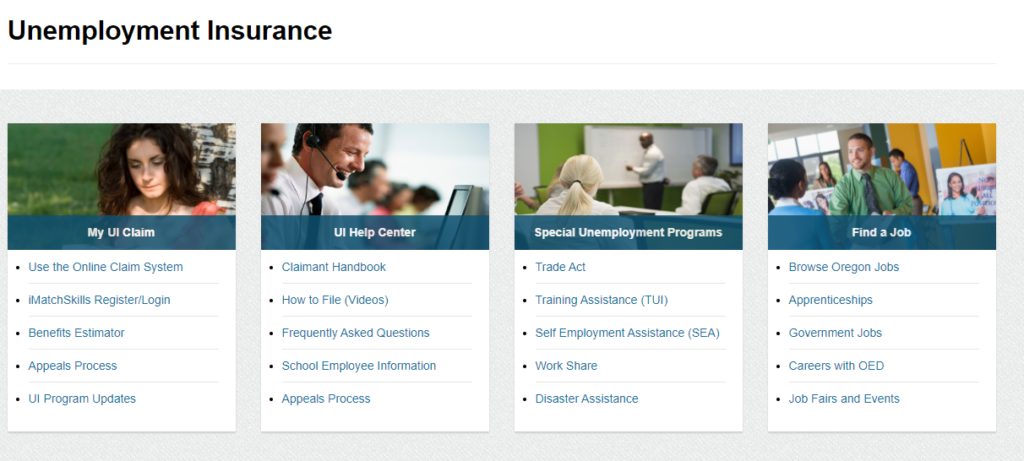

Withholding is voluntary. You can choose to have a flat 10% withheld federally and 6% in Oregon. If you are not already having taxes withheld, you can still do that here at this link with a 1040WH.

https://www.oregon.gov/employ/Documents/Authorization%20for%20Tax%20Withholding%20(Form1040WH).pdf

Another option is to set aside a couple of your next UI payments if any way possible to pay your federal and state taxes due when you file your 2020 tax return sometime in 2021.

Is there any way to see if I am having enough taxes withheld?

Yes – Oregon has a withholding calculator available here.

https://www.oregon.gov/dor/programs/individuals/Pages/withholding-calculator.aspx

The IRS has a page with information on unemployment withholding here.

Will I receive any documentation for my unemployment benefits so I can file my taxes?

Yes – In January of 2021, unemployment benefit recipients should receive a form 1099-G, Certain Government Payments, from the Oregon Employment Department. This form will come snail mail only. Here is a sample of what this form will look like.

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.