The Oregon College Savings Plan

A “Qualified Tuition Program” or “529 Plan” is a state-sponsored investment plan that allows a taxpayer to save money for a beneficiary’s education expenses. The 529 plan offers tax-free growth on savings and tax-free withdrawals for qualified expenses. Some states also offer annual tax credits or deductions related to the amount contributed to the account. You can use the account funds for a variety of education expenses, including tuition, books, technology, and some room and board expenses.

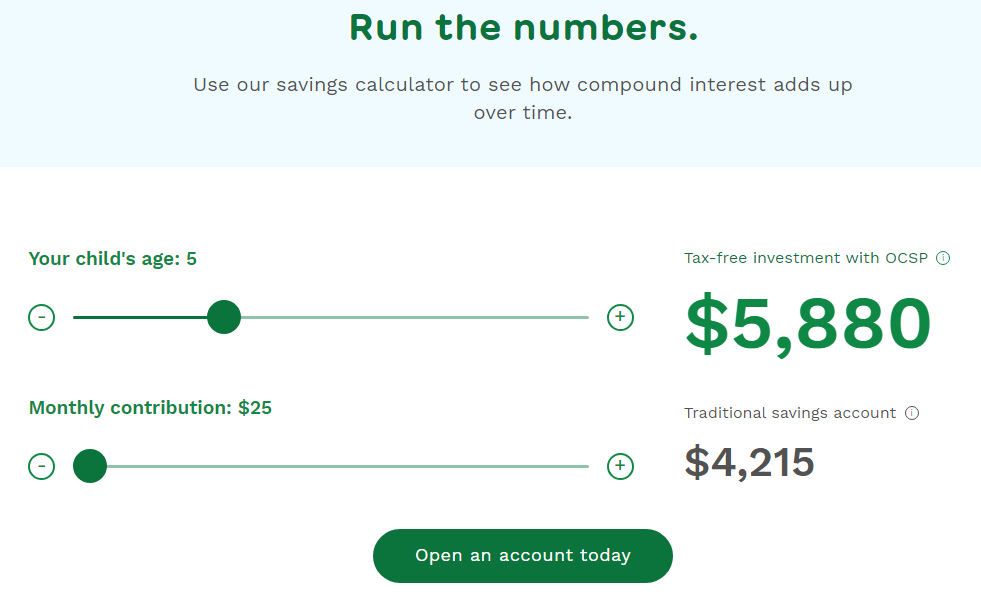

The Oregon College Savings Plan is administered by the Oregon Treasury Savings Network which is a division of the Oregon State Treasury. The Oregon 529 College Savings Plan is designed to help people in and out of Oregon save for a beneficiary’s higher education. Funds in an OCSP account are channeled into financial portfolios that invest in a variety of mutual funds, exchange-trade funds, and other investment vehicles designed to earn interest at a higher rate and more quickly than a standard savings account.

* Graphic courtesy of oregoncollegesavingsplan.com/thebasics

Which schools are considered eligible institutions?

Most public and private colleges and vocation/trade schools in the U.S. (and some abroad) are considered eligible, as well as apprenticeships and professional certification programs. Here is a list form the U.S. Department of Education.

Do I have to use my account to pay for an Oregon college or university?

No. You can use your funds to pay for qualified expenses at institutions in the U.S. and in some cases, abroad.

What is considered a “qualified expense”?

Most expenses related to a beneficiary’s higher education qualify as an eligible expense. Some of the most common qualified expenses as defined by the IRS include:

- Tuition and fees at eligible educational institutions

- Books and materials

- Supplies and equipment (e.g. computers, software, printers, etc.)

- Certain room and board expenses

Also, you can now use tax-free distributions from your Oregon College Savings Plan account to pay for qualified expenses for certain apprenticeship programs, as well as principal or interest repayments on any qualified education loan up to $10,000 for the beneficiary or a sibling of the beneficiary — up to a $10,000 lifetime maximum, per person.

What are the contribution limits?

The minimum contribution to open an OCSP account is $25. Any subsequent transactions – including contributions, withdrawals, and bank transfers – need to be at least $5 each. Individual online contributions are capped at $15,00 each. Larger contributions can be made by filling out the Contribution Form PDF.

Can I open more than one account?

Yes. You may decide to open separate accounts for different beneficiaries.

Do I have to live in Oregon to open an account?

No. You can live anywhere in the U.S. and have an Oregon College Savings Plan account, as long as you’re a U.S. citizen or resident with a valid Social Security number or tax ID.

Can you earn a state income tax credit when you contribute to someone else’s account?

Yes. All Oregon residents are eligible to contribute to an Oregon College Savings Plan account and claim the state income tax credit.

Is there a penalty for taking money out for non-qualified purposes?

Yes. Earned funds withdrawn for non-qualified purposes are subject to federal income tax, plus an additional 10% penalty.

Will I receive a tax form if I did not make a withdrawal from my account?

No. You will only receive a 1099-Q tax form if you withdrew funds from or closed your Oregon College Savings Plan account for that tax year.

Are investments in my Oregon College Savings Plan account guaranteed not to lose money or are they insured?

No. As with any investment, there is some risk involved. While Oregon College Savings Plan accounts are designed to help balance risk based on factors such as the beneficiary’s age and your overall risk tolerance, there is no guarantee that your portfolio will generate earnings.

Are there fees associated with the account?

Yes. Like a brokerage account that has management fees the OCSP program does as well. The idea behind these accounts and account fees is that the return on the investment even with paying the fees is still greater than going with a traditional savings account or investment. Another way to think of the OCSP account is that you are paying someone with the knowledge to make slightly more aggressive financial decisions with your investment and you’ll both do better in the end. The fees are deducted from the assets in each portfolio and are not a separate transaction. The average annual cost is $2.80 for every $1,000 you invest.

Who manages my OCSP Account?

The Oregon College Savings Plan is a Qualified Tuition Program sponsored by the State of Oregon and distributed by the Board. Vestwell State Savings provides program management services to the Oregon College Savings Plan, including recordkeeping and administrative support. Sellwood Consulting, LLC, provides investment advisory services to the Oregon College Savings Plan. The Underlying Funds in which the Oregon College Savings Plan’s Portfolios are invested are managed by various investment managers, including Champlain, Dimensional Funds, DoubleLine, Dodge & Cox, LSV, TIAA, T. Rowe Price, and Vanguard. The Underlying Funds included in the Oregon College Savings Plan Portfolios may change at any time without notice.

The Portfolios are not mutual funds, although they invest in mutual funds. When you invest in the Oregon College Savings Plan, you are purchasing Portfolio Units issued by the Program. Investment returns are not guaranteed and will vary depending upon the performance of the Portfolios you choose. You could lose money by investing in the Oregon College Savings Plan.

Where can I get more Information on the OCSP?

The Oregon College Savings Plan Disclosure booklet found at the bottom of the webpage here is a great resource.

Oregon College Savings Program Contact Information

Phone

1-866-772-8464

Monday through Friday, 6 a.m. to 5 p.m., Pacific Time

Online

www.OregonCollegeSavings.com

Regular Mail

The Oregon College Savings Plan PO Box 534440

Pittsburgh, PA 15253 – 4440

Overnight Delivery

The Oregon College Savings Plan Attention: 534440

500 Ross Street, 154 – 0520

Pittsburgh, PA 15262

All information courtesy of the Oregon College Savings Program found at www.oregoncollegesavings.com

This material is compiled from sources SST believes to be reliable. The possibility of error does exist. The material is intended only as educational and may omit information on exceptions, qualifications, definitions, and effective dates. The reader should not rely solely on this material but should review original sources to determine the law and applicability for each situation. Neither the author nor Solid State Tax Service, LLC will be responsible for any error, omission, or inaccuracy under any circumstance.