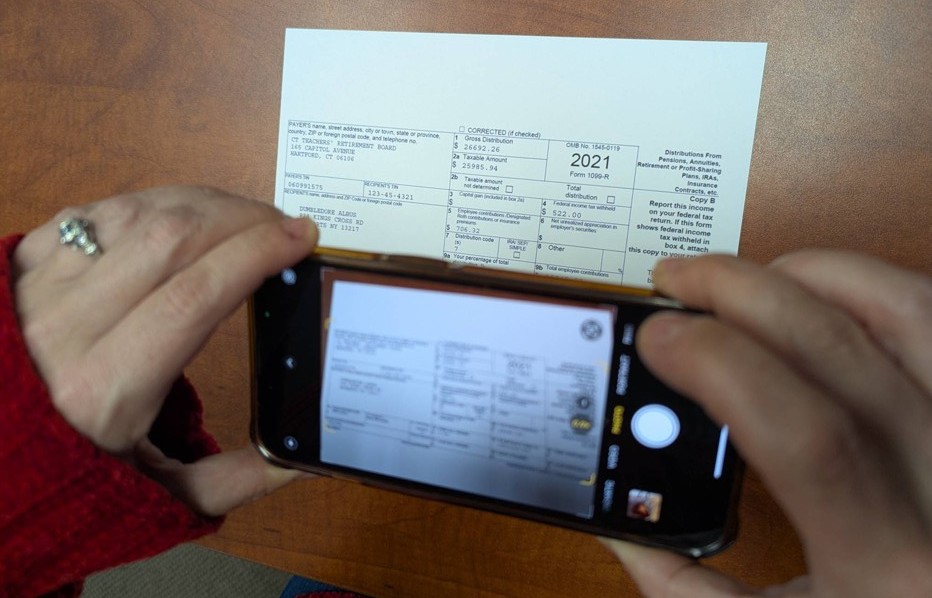

SST has a secure and easy to use web-based portal where we can complete the tax process remotely by exchanging files electronically. You can also access any historical tax documents we have finished together including your Federal 1040, Oregon 40, W-2’s, 1098’s, etc. The portal has a mobile friendly interface that allows you to take cell photos or scan pdf’s of your tax documents and upload them directly to us. New clients and existing clients please use the “Guest Exchange” for all uploads. The guest exchange offers the same document encryption and saves you the hassle of remembering your password every year. After you have successfully uploaded all your tax and income documents in one shot (W-2’s, 1099’s, 1098’s, etc.), we will send you a confirmation that we have received them. We then begin preparation of your tax return. Tax preparation turn-around time is 1-week. (please check your portal frequently and always within 1-week from your upload). After 1-week or less your taxes will be complete and we will upload the (3) signature documents we need signed to your portal account. (Engagement Letter, 8879 E-File Authorization, and Bank Direct Deposit confirmation for refund from fed, state, or both).

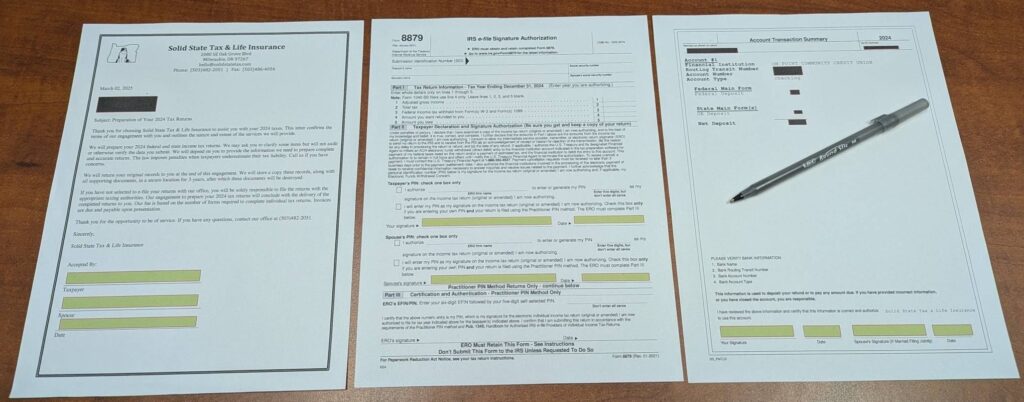

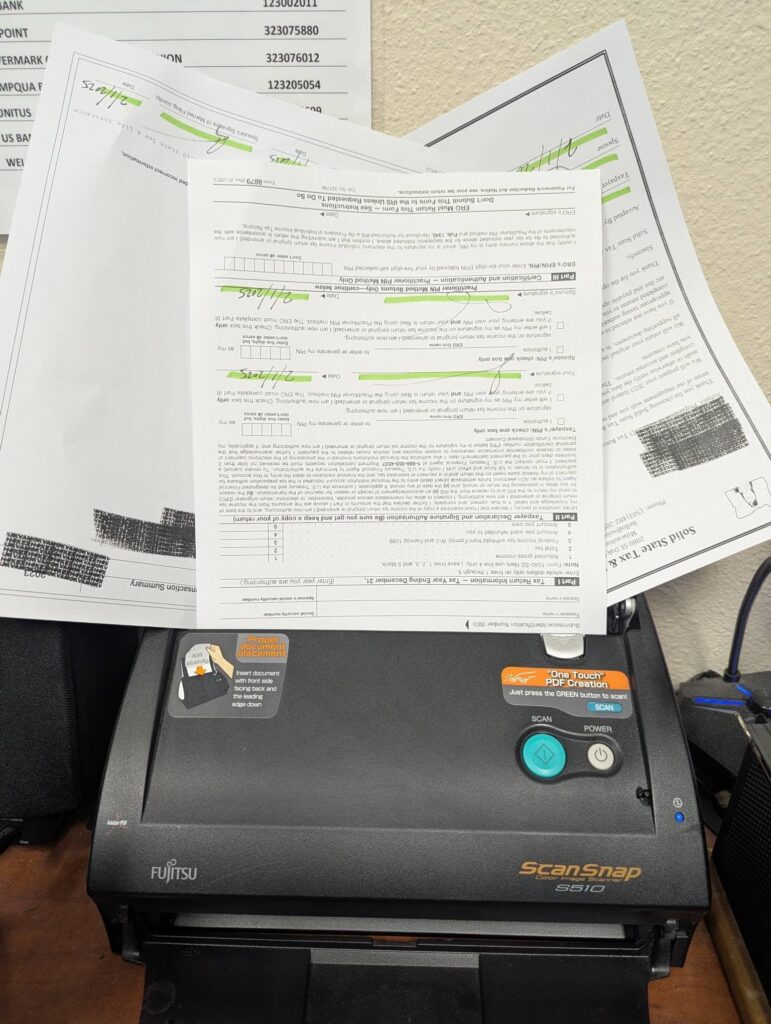

You’ll then download the documents we need signed. Follow the image above and sign all (3) documents at the green highlights. (there will only be (2) signature documents if you don’t receive refunds from fed and/or state). This process (including your signatures) can accomplished electronically right on your pc or cell phone if you have that technology available through adobe and other providers. If you aren’t able to sign the documents electronically, the process is still easy. You’ll print the documents out we need signed (see photo above), sign the 2 or 3 documents, then scan or photo the documents with your cell phone, and upload them right to the guest exchange.

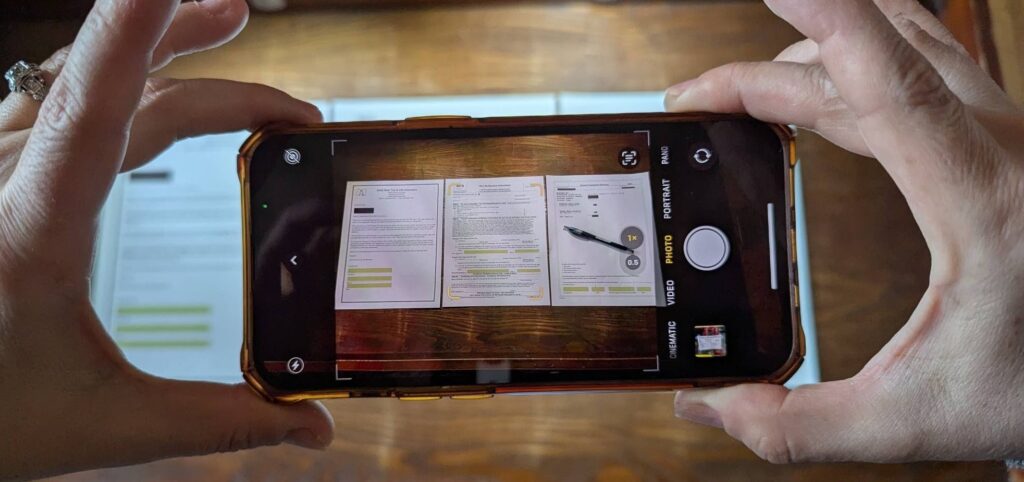

This process can also be completed by snapping photos of your signed documents and uploading them to the portal with your cell phone. You can take photos of the individual documents or a focused single photo of all (3) docs togther like the image below.

Please follow this process quickly after receiving your signature documents to avoid any additional line-item late response or late payment fees on your invoice. (Payment due dates and penalties on our bill are firm and if unpaid will lead to termination of our working relationship and removal from our tax family)

Click Here to Pay your Bill by Credit Card – Thank You for your Business

Follow the QR Code below to pay for tax prep by Venmo.

After we have received payment, we will electronically file your tax return and send you a confirmation once it has been accepted by fed, state/s, and any other tax authority. At this time we also place a complete pdf copy of your tax return, any payment vouchers if you owe fed, state, Tri-Met, MCBIT, PFA, SHS, and any other relevant documents in to your client portal account.

First-Year Clients – here is a list of what we will need uploaded to your guest portal all at once. If you’d like a response don’t miss anything here and show extensive attention to detail. Incomplete or sloppy uploads will be deleted for your security and will receive no response from our team.

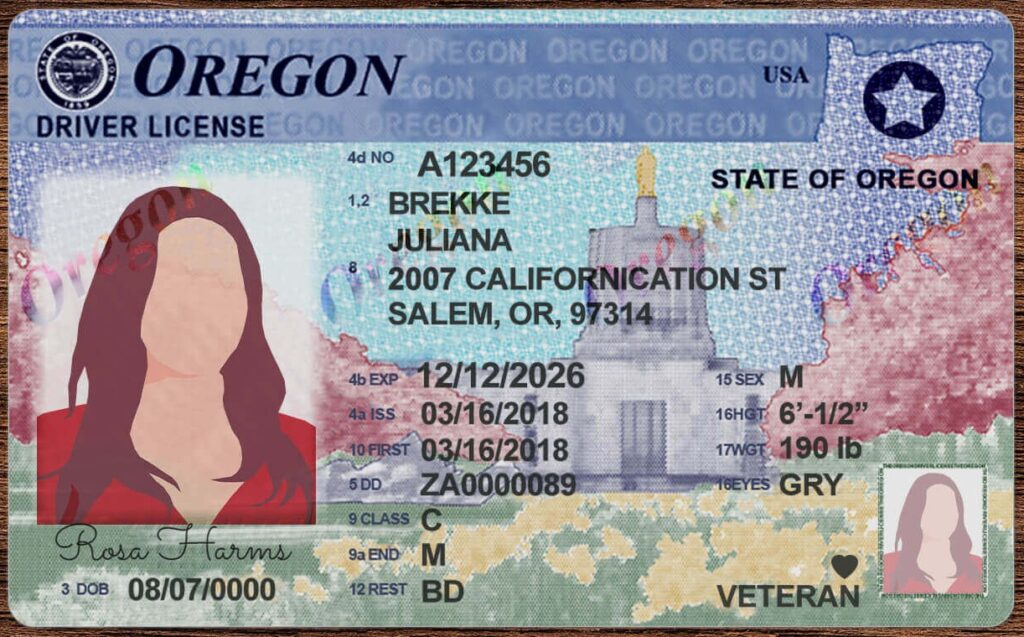

- State Driver’s License or ID Card (front side only – jpeg or pdf). The state driver’s license is a requirement by the Oregon Department of Revenue and is submitted with your e-file for security reasons to proactively prevent Manual Processing.

- Upload a complete copy of previous year’s tax return – or last year you filed (fed and state). Please ensure your SS# is not X’d out. If the SS#’s are X’d out no problem. Write all taxpayer, spouse, and dependent’s SS#’s on a piece of paper and snap a clear photo with your phone. Upload with your previous year’s tax return to the guest exchange, then shred your piece of paper. Using the SST portal is that easy and secure.

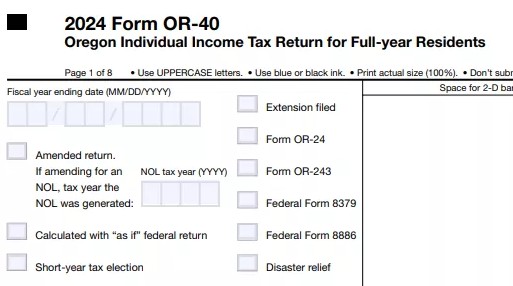

- Current year’s source and income documents (once ready) in one upload – please upload these in one sitting and don’t trickle these in as you receive them (W-2’s, 1099’s, 1098’s, 1099-B’s for brokerage accounts, etc.)

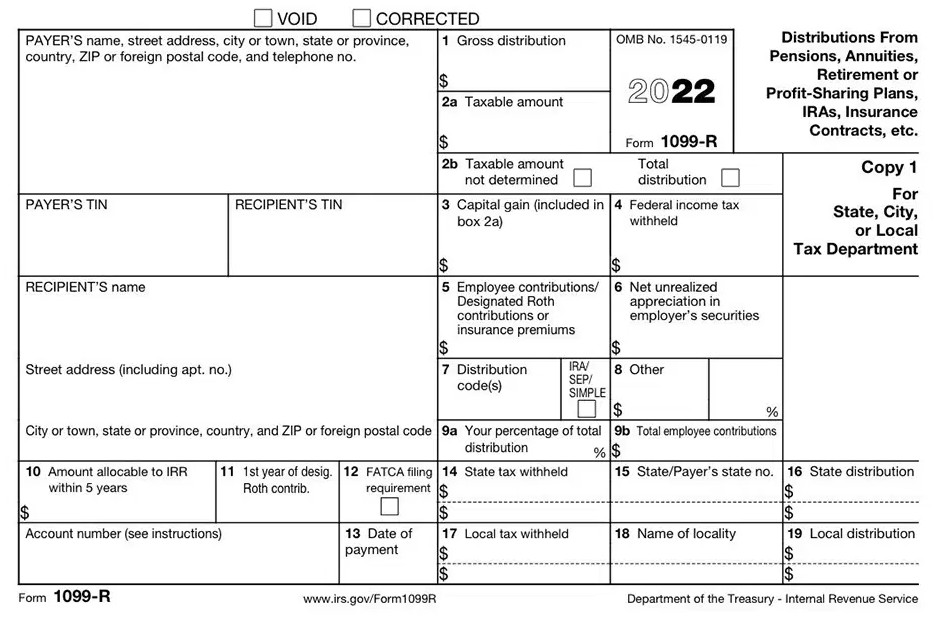

- Bank routing and account number (This is if you typically receive refunds and would prefer they didn’t arrive as a paper check to your mail or P.O. Box). If you received a refund on your previous year’s taxes the routing and account numbers are usually at the bottom of the last page of your federal 1040. As long as it isn’t X’d out anywhere on the routing or account number this will suffice.

Returning Clients – Please use the guest portal for upload annually. We’ll refresh your client portal once your taxes are done and we need to drop signature documents in your specific portal account. Here is a list of what we will need uploaded to the guest portal all at once. Carelessness without attention to detail on this upload may lead to termination of our working relationship and removal from our tax family.

- Current year’s source and income documents in one upload – please upload these in one sitting and don’t trickle these in as you receive them (W-2’s, 1099’s, 1098’s, brokerage accounts, etc.)

- Bank routing and account number (This is if you typically have balance dues, are expecting a refund this year, and don’t want it to come as a paper check to your mail or P.O. Box). Our software carries forward your previous year’s bank information so if no changes to the account don’t worry about providing this every year.

- New driver’s license if your current one expired recently.